This window of Loan Performer allows the user to set the parameters of the Central Bank of Madagascar Regulatory Reports. After the configuration, the user will be required to go to the second tab "Generate CSBF Reports" in order to produce these reports

How to configure CSBF Report

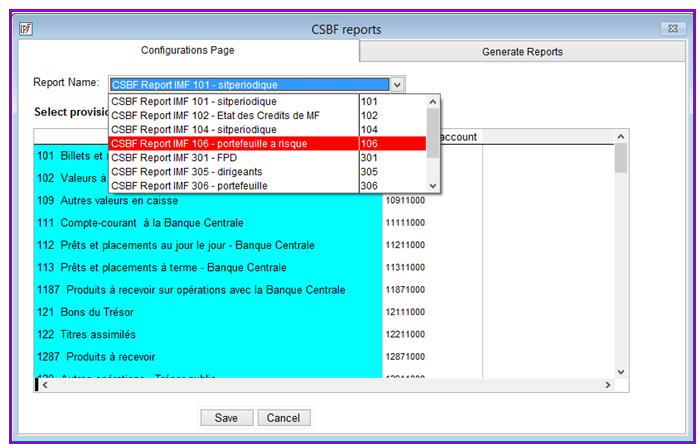

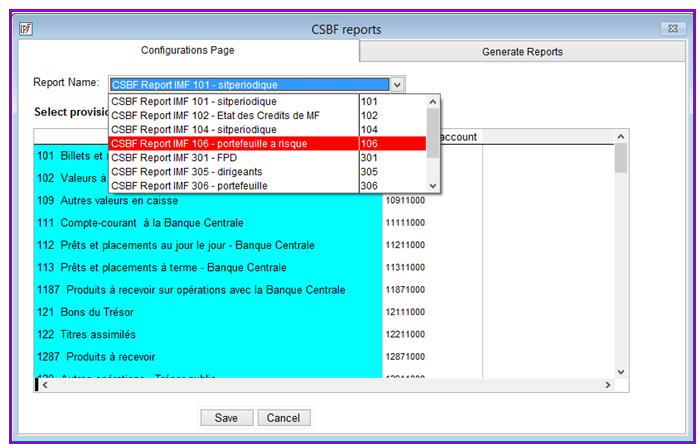

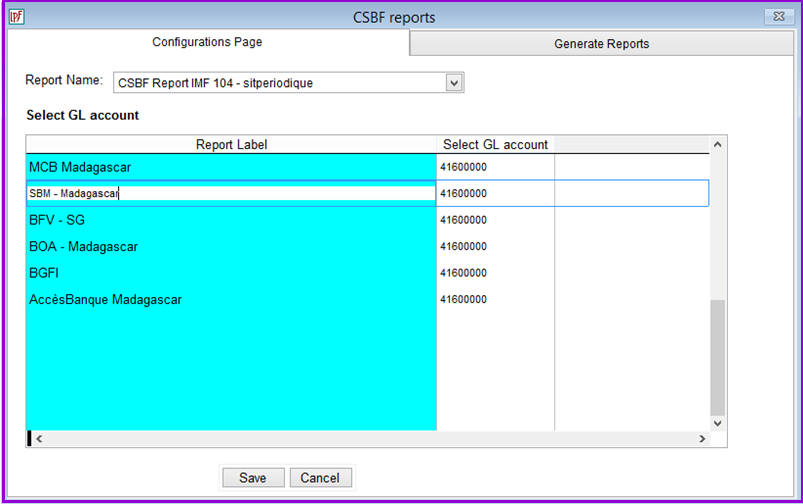

To configure the CSBF reports you go to Accounts/Regulatory Reports/Central Bank of Madagascar/CSBF Reports/Configure CSBF reports, the following appears:

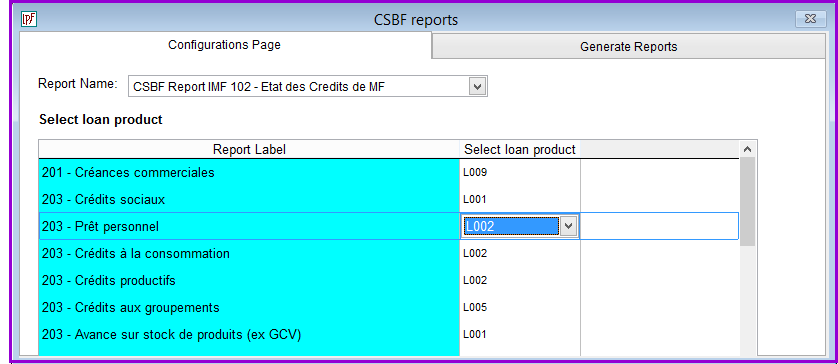

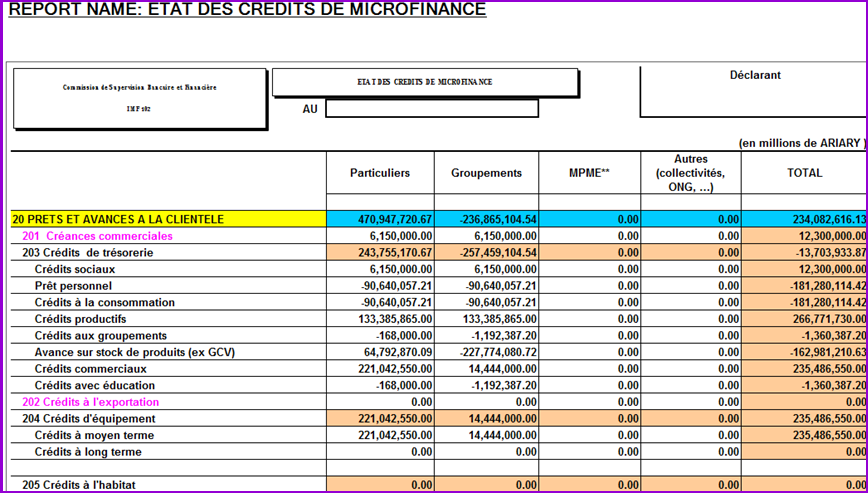

2. IMF 102: IMF 102 has a list of loan products. The user should be able to link these to the loan products in LPF. The report will automatically figure out which GL account to pick based on this selection and produce the correct total.

IMF 104, User needs to indicate which savings product is ‘Dépôts à vue’. The report will find its way to the GL account of that product and produce the balance. For Comptes-courants créditeurs’ (Accounts payable) user needs to be asked which GL account has this balance. The same for 213 ‘Comptes d'épargne à régime spécial’(Special Savings Accounts) and 215 ‘Dépôts de garantie’(Security Deposit).

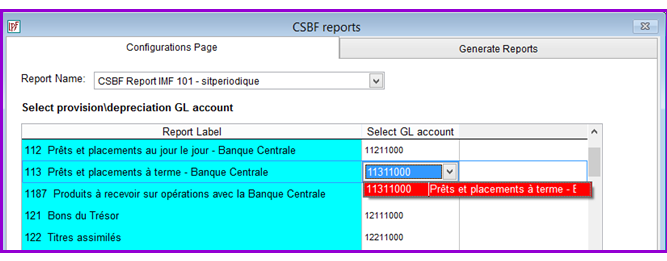

For IMF 104, the “Comptes-Courants des banques locales”, we need to present a configuration screen where the user can match these bank accounts against the GL accounts in LPF. IMF 104 User should be able to link ‘Provisions’ to a GL account. Using loan category 1, LPF should be able to figure out the court, moyen and loan term part of the total.

IMF 301 Add ‘Provisions à constituer’ and ‘Dividendes, ristournes ou bonifications prévus’ to Configuration Screen of the report. Also the calculated value ‘Fonds Propres’ should be saved every time – one of – the previous 2 variables change as it is a source for other reports.

IMF 305: The users need to know the savings product that corresponds with “Sommes détenues en garantie”. LPF will then figure out the balance on that savings account for the specified board members.

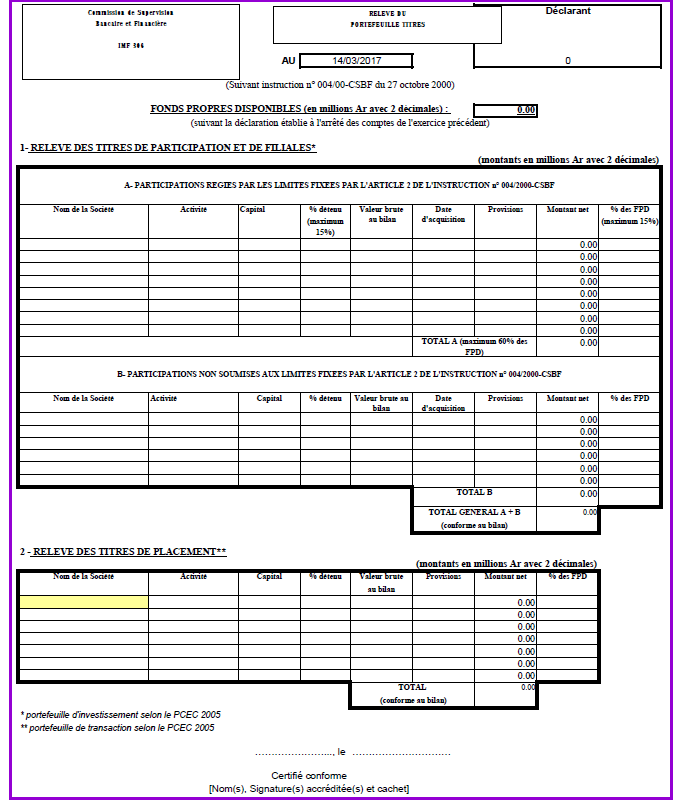

IMF 306: This report is presented to the users entirely for manual data entry only after printing. It looks like one below:

IMF 308

IMF 401

See 17078 General Configuration CSBF reports Madagascar

For the Time-Deposits, there is no product to ask for. Here we have to segregate according to period of the Time-Deposit (2-3 months, 3-6 months etc) as well as client type.

For 213 we use the same configuration screen that asks for the product code.

214 is for ‘Bons de caisse’. These are Time-Deposits where interest is received up-front. We do not have this product in LPF and our clients do not have this either.

215 gives the account balance split according to client category

216 to 219 just gives the balance total, no split according to client needed

Etat des renseignements divers, page 2

Under « Comptes-Courants » we only put « Depots a Vue », under “Comptes de depots” we put all other savings products (summarised, but not term deposits).

So at configuration we need to ask the user what is the GL account for « Depots a Vue » and what are the GL Accounts for the other products.

“Mouvements Debiteurs” is total withdrawals

“Mouvements Crediteurs” is total deposits

For the “Comptes-Courants des banques locales” we need to present a configuration screen where the user can match them against a GL account. Actif/Passif means debit or credit.

“Provisions” is normally linked to account 29. Both IMFs don’t use ‘Long Terme’, and 29611 is used for Moyen Terme. So the balance for Court Terme is the balance of 29 less the balance of 29611

The Nº 1 Software for Microfinance